With Africa’s largest population and a fast-growing digital economy, Nigeria is at a turning point. While oil has long dominated its economy, fintech and mobile banking are reshaping how Nigerians access and manage money. A young, tech-savvy population and increasing mobile connectivity are driving innovation, making Nigeria a key player in Africa’s financial future.

Financial hub: Lagos (Ranked globally 100th)

Key economic development strategy: Nigeria Agenda 2050, Nigeria Payments System Vision 2025 (psv 2025)

Economic, financial services and fintech overview:

The largest country in Africa by population, Nigeria’s economy has historically relied on oil. However, as a middle-income country with much economic potential, the country is at a crossroads to further develop.

Besides having the largest population in the MEA region, half of Nigeria’s population is under 19 years of age, and over 65 per cent are under 35 years old. According to Hootsuite, there are over 187 million mobile connections (90 per cent of its population); 10 to 20 per cent of the population have smartphones while the rest are using traditional mobile phones. However, it is a nation of contrasts, as half the population does not have internet and many are still financially excluded.

Nigeria often is one of the biggest venture capital (VC) recipients in the continent. For instance, in the first quarter of 2002, Nigeria had the most at $600million. In terms of key developments in fintech, there are several: Nigeria introduced a digital central bank currency called the e-Naira, released the exposure draft of Open Banking in 2022, and the CBN ordered all banks to stop transacting with entities dealing in cryptocurrency.

Despite this, cryptocurrencies are very popular in Nigeria. Many point out that the 2016 economic recession in the country could have caused Nigerians to flock to digital currencies. This change in behaviour propelled Nigeria to have the largest crypto market in Africa by 2019 and one of the largest user bases in the world. Cryptocurrencies have remained popular despite the ban. A report by KuCoin showed that at least 33.4 million Nigerians aged between 18 and 60 had invested in digital assets in the past six months.

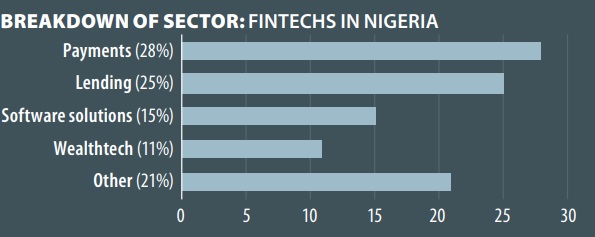

Breakdown of sector:

Key organisations:

■ Central Bank of Nigeria – Country’s central bank

■ Securities and Exchange Commission of Nigeria – Country’s security and exchange commission

■ National Insurance Commission (NAICOM) – Commission to oversee the insurance sector

Timeline of key fintech highlights:

Nigeria has some key milestones pertaining to fintech as a whole:

- 2014 International Money Transfer Services

- 2015 Guidelines of Mobile Money Services; Guidelines on Int’l Mobile Money Remittances Service; Guidelines on Mobile Money Services

- 2018 Regulation for Bill Payments; Guidelines for Licensing & Regulation of Payment Service Banks

- 2019 Electronic Payments and Collections for Public and Private Sector

- 2020 Framework for Regulatory Sandbox Operations (‘Sandbox Operations Framework’) (in December 2022 the public was invited to take part via expression of interest); also Guidelines on Operations of Electronic Payments Channels

Key statistics of the country:

This is an excerpt from The Fintech Times: Middle East and Africa 2024 report – read online

The post Nigeria’s Fintech Growth: Key Trends and Economic Shifts in 2024 appeared first on The Fintech Times.