Payments giant Checkout.com has announced a major strategic move to solidify its position in the US enterprise market after the State of Georgia Department of Banking and Finance accepted its application for a Merchant Acquirer Limited Purpose Bank (MALPB) charter.

The acceptance of the MALPB charter application is a pivotal moment in the firm’s North American growth trajectory. Once approved, the charter will grant Checkout.com direct access to US card networks, enabling it to act as its own acquirer—a capability that positions it on par with major established US incumbents. This power is set to deliver high-performing payments, enhanced control, and a smoother experience for its growing base of enterprise merchants.

US market poised to be largest region

The pursuit of the MALPB charter follows a period of hyper-growth for Checkout.com in the US. Since entering US merchant acquiring in 2021, the market has rapidly accelerated to represent 15 per cent of the company’s total global business. In 2024 alone, US volumes grew by over 80 per cent, outpacing every other region globally. The company is currently on track to process more than $300billion in eCommerce payment volume in 2025.

This investment is laser-focused on optimising payments performance for enterprise merchants. The acceptance of the Georgia MALPB charter application is a natural next step, empowering Checkout.com to deliver a truly US-first payments experience.

“The Georgia MALPB charter is a pivotal moment for our business, marking a ‘line in the sand’ in our commitment to the US,” said Guillaume Pousaz, CEO and founder, Checkout.com. “Just as our UK acquiring licence in 2012 was a catalyst for our business, we see this as the definitive accelerant for our growth in the US. The US is already our fastest growing region, and we firmly expect it to become our single biggest region globally by the end of 2027.”

New leadership and Atlanta hub

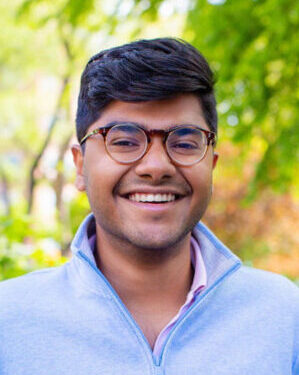

To lead the new entity and manage the next phase of North American expansion, Checkout.com has appointed industry veteran Jordan Reynolds as the new MALPB CEO and head of North America Banking. Reynolds, who brings experience from Elavon, SunTrust, and PwC, will be responsible for running the new entity, managing compliance, and locking in direct access to the US card networks.

The banking charter also coincides with the establishment of a new office in Atlanta, Georgia, a strategic hub for US payment and banking operations. This location will support Checkout.com’s established offices in New York and San Francisco, underscoring a significant expansion of its North American capabilities, which recently included a launch in Canada.

“This charter is a clear signal that we are here to offer US enterprise merchants a truly different choice,” said Jordan Reynolds.

“Our focus on building a unique, digital-first, enterprise payments proposition is designed to win. We aren’t just a one-size-fits-all solution, we are a powerful alternative to legacy and incumbent players in the market.”

Checkout.com is trusted by some of the world’s largest and most innovative businesses, including global enterprise customers such as eBay, Klarna, GE Healthcare, and Pinterest, which rely on its global digital payments network that supports over 145 currencies and processes billions of transactions annually.

The post Checkout.com Accelerates US Expansion with Georgia Banking Charter Milestone appeared first on The Fintech Times.